Environmental Services Update

See recent news in the Environmental Services industry.

January 2020

It is Acquisitions Galore for Many Major Waste Haulers

Similar to the previous two years, the waste industry saw many of its largest players outpacing their forecasts for acquisitions in 2019 and the trend is expected to continue in 2020.

A prolonged economic boom and lower corporate tax rates are the main driving factors behind this increase in merger and acquisition activity. Other factors supporting this trend include the ongoing driver and mechanic shortage, shrinking landfill capacity, raising disposal rates, and increasingly stiff competition in the industry.

The biggest news of 2019 occurred when Waste Management, the #1 waste hauler, announced their intent to acquire Advanced Disposal, the #4 waste hauler. This pending deal is Waste Management’s largest deal in decades and should close in Q1 2020 following approval by the Department of Justice with parts of Advanced expected to be spun off to other haulers in areas where Waste Management already has a large presence.

GFL Environmental’s rapid rise to the #4 position was accelerated after purchasing Waste Industries in 2019. Following that acquisition, the Canadian company’s CEO and CFO reported to WasteDive that their North American expansion is “just getting started”. In recent news, GFL made an announcement in December that a deal was in place to purchase Virginia-based County Waste.

The industry’s #3 hauler, Waste Connections’ CEO reported to Waste Dive in October 2019 that the company had extended offers of more than $600 million since July 2019 and more are planned for 2020. One of those offers was recently in the news as Waste Connections announced that it had acquired the York, PA based regional hauler Penn Waste.

While not having the same hype as some of the above items, the #2 hauler Republic Services as well as many large regional players like Casella Waste Systems have also ramped up activity and have plans for continued growth in 2020.

The Spanish company FCC Environmental is also notable since it has been making major inroads in the U.S. since 2014. With over 100 years of experience and service to over 60 million people in Europe, the company decided to enter the U.S. since it has the largest solid waste market in the world. Although the company has been primarily focused on organic growth in its first five years, it is now exploring potential acquisitions and will probably be a major player in the U.S. in the near future.

With all of this activity going on in the industry, many companies have or will see their waste hauler change hands. Based on Edge’s past experience with hauler acquisitions, the purchasing company will more than likely adhere to any contracts that are in effect and the service will continue as it had previously with no interruption. Typically, the only changes that take place are updates to the labeling on the dumpsters and a gradual transition to a new invoice format and change to the remit to address.

Waste Haulers Voice Disapproval of Immigration Stalemate

As reported in a previous update, the waste industry is suffering from a shortage of drivers and mechanics. What wasn’t previously mentioned is that immigration uncertainty has had dramatic impacts on the issue.

At last year’s WasteExpo, multiple waste haulers reported that immigration was becoming a bigger issue in terms of both potential employees and current employees that could be deported due to status changes.

Waste Management CEO, Jim Fish, stated that about a quarter of his drivers are Hispanic and that expanding recruitment to a more diverse population is key to Waste Management’s growth.

In a 2018 interview with Waste Dive, Waste Connections CEO, Ron Mittelstaedt estimated that 35-40% of people hired into the industry over the last decade have been immigrants.

At WasteExpo, Republic Services President Jon Vander Ark told WasteDive “It’s a pain point for some of our workers and everyone is affected by it, even for people who don’t have to worry about their own immigration status, they’re connected to someone who is.”

Vander Ark said that utilizing people that are already here is a bigger issue than getting new people into the country. For example, Republic Services has employees from El Salvador, Haiti, and Nicaragua who are at risk of deportation if certain rules are changed. This uncertainty creates a stressful situation, which leads to morale issues, productivity issues, and absenteeism.

WCA Waste CEO Bill Caesar commented that many of the employees that face possible deportation have worked hard to move from entry-level jobs like riding on the back of trucks to being highly valued employees like truck drivers. Caesar emphasized how changes in the immigration laws can upend lives. Employees with families and homes in the U.S. may be sent back to countries of origin that they haven’t seen in decades. Caesar noted that higher levels of legal immigration wouldn’t be an instant fix to the current labor shortage, but the past precedent has shown that it could definitely help in the long run. Caesar commented that there is an important history of past immigrant groups in the waste and recycling industry and that the industry has been a natural first home for first generation people.

Typically the waste industry maintains a low profile in sensitive political issues but the current labor shortage for front line employees, especially drivers, has caused even the major players to express their concerns.

To be continued…drivers and mechanics still wanted!

The Good, The Bad, and The Ugly Facts on Single Stream Recycling

Although China’s National Sword Policy, enacted in early 2018, continues to have major effects on the recycling industry in the U.S., the changes regarding the collection, processing, and disposal of recyclables are not all bad.

The Good:

The contamination rate of collected recyclables in the U.S. was out of control prior to China’s changes. All parties are now working together to lower contamination rates and to produce more marketable bales of material for reuse.

Most businesses and communities nationwide continue to recycle on a regular basis.

China is still receiving a substantial amount of recycled materials from the U.S.

Many U.S. recyclers can accept additional material and the industry is working on transportation issues and other logistics to get more recycled material to the facilities.

The number of recycling facilities in the U.S. is growing and this will result in new outlets for some sorting facilities.

Most people and organizations are still in favor of recycling even if it means increased costs.

The Bad:

Some communities have had to make changes to their recycling programs in order to meet the new quality standards and higher costs. For instance, some municipalities have changed from a one day a week pickup to every other week. Others have changed some or all of their recycling from curbside collection to a drop off facility.

Recycling sorting facilities are having to add labor, upgrade or add equipment, and slow down their lines in order to produce more marketable bales of recycling material. Unfortunately, these facilities are unable to absorb the costs associated with these changes and are increasing their rates to offset the added costs.

The Ugly:

A limited number of communities, although growing, have suspended or cancelled their recycling programs and are now sending some or all of their recycling to landfills or waste-to-energy facilities.

Some businesses, which could not get their staff to adhere to the new stricter quality requirements for recycling, have changed some recycling dumpsters over to trash dumpsters in order to avoid expensive contamination fees.

Recyclable materials in some areas are being landfilled or incinerated due to contamination issues or rising costs.

Some recycling companies have had cease operations due to the major downturn in the market.

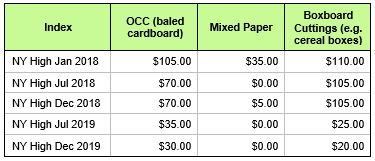

The value for bales of recyclable materials continues to decline as shown below.

The bottom line is that recycling is still worth the effort. The industry may be in a transition state at the current moment but recycling still preserves landfill space, reduces emissions, saves energy water and natural resources and supports tens of thousands of jobs. It will take some time, but the industry will recover.

Severe Weather Service Alert

When severe weather strikes, some waste customers may experience delays to their service schedule.

Although haulers attempt to maintain their service schedules, safety is their main concern and operational decisions are based on the conditions in each area. When a storm is in your area, please be aware that there may be delays and be sure that snow and ice is cleared from the area around the containers to allow access.

Annual Recycling Reports

Many local municipalities have implemented mandatory annual recycling reports for commercial customers in order to track the amount of waste material that is being recycled and in some case to apply for grants. As part of Edge’s service to our environmental services clients, Edge will help customers obtain the needed information and provide assistance to complete the associated forms. The reports vary by municipality, range from being simple to very complex, and are typically due early in the New Year. Many municipalities have implemented these reports to comply with state requirements such as Pennsylvania’s Municipal Waste Planning, Recycling and Waste Reductions Act (Act 101). Please contact Edge if you need any assistance.

At Edge, we constantly monitor the market for ways to help our customers improve their sustainability efforts and reduce costs.

Please feel free to reach out to our experts should you have any questions related to the above articles or the environmental services industry.

February 2019

The U.S. Recycling Model Is Broken

With a contamination rate of well over 20%, the current U.S. recycling model is costing the system time and money as well as creating safety hazards for workers. Well-intentioned consumers who are trying to do the right thing by recycling everything they think could or should be recycled are causing more harm than good by placing inappropriate items in their recycling containers. Although the current recycling model seemed to be working for decades, China’s stricter regulations on recycling imports that got enacted last year exposed the fact that the current U.S. model is broken.

As highlighted in previous updates, China’s change caused havoc in the recycling industry by banning certain materials and implemented tight restrictions on others. The change accentuated the U.S.’s high contamination rate, caused commodity rebates to plummet, and recyclers to reevaluate their processes. Regrettably, with recycling costs continuing to increase, commodity values expected to remain low, and packaging becoming more complex, recycling in the U.S. will undoubtedly get harder before it gets better.

In response to the current state of the recycling market, many haulers and recyclers have recently reduced the number of items that they will accept in their single stream recycling. The typical change is to remove items that have low value and/or high processing costs while maintaining the more profitable items. As with any change, communication and implementation are key.

In order to try to educate customers on the changes, some haulers are including flyers with their invoices using simple messages like “Know What to Throw”, “Keep It Simple” and “Recycle Right”. The flyers combine these catch phrases with concise large pictures of the main items that can and cannot be recycled. Republic Services has even created an entire website to attempt to clarify what should and should now be recycled. The challenge for the haulers is to get their material into the right hands and to get consumers to read and follow the new instructions.

Fortunately, there is some good news on the horizon for the U.S. recycling industry. Product manufactures, haulers, and recyclers all agree that there are problems with the current recycling system. All three industries are now working together at being proactive, instead of reactive. They are actively participating in efforts to “rethink the stream” in order to correct the current problems and to address future issues before they occur.

The other good news for the U.S. recycling industry is that numerous domestic recycling facilities are currently under construction or in the planning stages. The new facilities should have a positive impact on the commodity prices for recycled items in the coming years.

In order for the U.S. model to improve, everyone needs to do his or her part. The best thing that consumers and businesses can do to help is to make sure they are recycling the correct items. The new rule is “When in Doubt, Throw It Out”. Please reach out to one of Edge’s experts if you have questions as to what can be recycled in your area or contact your hauler directly.

The Evolving Ton

At the Northeast Recycling Council’s (NERC) Fall Conference this past October, quite a few presentations focused on recent product packaging changes and their effect on the waste and recycling industry. Primarily driven by the growth of e-commerce, companies have been shifting towards more lightweight, convenient, and break resistant packaging. As a result, a ton of recycling material arriving at a Material Recovery Facility (MRF) today is a very different combination of materials from a few years ago. The waste industry refers to these changes in the recycling stream as “the evolving ton”.

It is a well-known fact that the shift to online shopping, usually referred to as the “Amazon Effect” because of Amazon’s early and continued dominance, has caused an evolution and disruption in the retail market. It is a lesser-known fact that it has also had a substantial impact on the waste and recycling industry.

Online shopping has caused a dramatic increase in the amount of boxes and packaging materials sent to consumers’ homes. MRFs are now processing much more of these materials than in the past because many of these items are now ending up in curbside recycling. Unfortunately, many of these boxes get rejected as trash because they are smaller than what the MRFs sorting equipment was designed to handle. As a result, these boxes are actually adding to the MRFs processing and disposal costs instead of its increasing revenue.

Manufacturers are also now using more diverse materials in their packaging design in order to save on shipping costs and to lessen damage in transport. As an example, goods like tuna fish, petfood, and dish soap are sometimes packaged in multi-layered pouches instead of metal cans. Although the materials in these pouches can technically be recycled, most MRFs cannot recycle the material because of the complex layering. Additionally, the design of a MRFs sorting process may actually result in these pouches contaminating other types of recycling if they are sorted incorrectly.

As another example of recent packaging changes, plastic bottles and aluminum cans are now much thinner than in the past. Although almost all MRFs were designed to recycle these materials, many more bottles or cans now need to be processed in order to produce a ton for resale than just a few years ago. Once again, the effect of having to process the extra material is adding to the MRFs processing costs.

Items other than packaging changes are also affecting “the evolving ton”. For instance, MRFs have seen a dramatic decrease of newsprint over the last couple of decades. This decrease, primarily caused by a shift to using online media, has been a major factor in the decline in newspaper subscriptions as well as other print media.

The Dumpster of the Future is Here

Several companies are now offering devices that can be mounted onto dumpsters in order to provide container fullness and content monitoring. These futuristic gadgets use wide-angle cameras and ultrasonic sensors to feed real time data to web-based software for viewing and reporting. The devices also contain a tipping sensor and GPS to verify that the containers are serviced on time and to track their location. Some devices also apply sophisticated logic to determine a contamination score.

The sensors in these units are enclosed in an extremely durable housing and need to be mounted in a certain position on the container to provide accurate data. The devices come with a long life battery that lasts approximately five years and their target market is for both generators and service providers.

Service providers can use this technology to help right size customer’s containers, optimize routes, divert contaminated recycling containers to landfills, charge customers for the contaminated loads, and to assist with customer training.

Generators can use the devices to right size their containers, manage contamination at the source, identify areas for improvement, and to train staff on best practices. The sensors can also be used to measure recycling rates, improve sustainability, detect illegal dumping, and to verify service schedules.

Although these devices have quite a few benefits, everything typically boils down to return on investment and cost savings. Upfront costs include the purchase of a minimum quantity of devices, as well as installation and training costs. Recurring costs include monitoring fees and costs for ongoing maintenance. Two additional drawbacks to the devices would be to get the haulers to agree to allow the devices to be mounted onto their containers and then managing container swap outs.

When taking Edge’s current customer base into account, Edge’s initial evaluation of this technology is that the costs currently outweigh the benefits. However, Edge will continue to monitor this maturing technology and continue to weigh the benefits against the costs for current and future customers.

Severe Weather Service Alert

When severe weather strikes, some waste customers may experience delays to their service schedule.

Although haulers attempt to maintain their service schedules, safety is their main concern and operational decisions are based on the conditions in each area. When a storm is in your area, please be aware that there may be delays and be sure that snow and ice is cleared from the area around the containers to allow access.

Annual Recycling Reports

Many local municipalities have implemented mandatory annual recycling reports for commercial customers in order to track the amount of waste material that is being recycled and in some case to apply for grants. As part of Edge’s service to our environmental services clients, Edge will help customers obtain the needed information and provide assistance to complete the associated forms. The reports vary by municipality, range from being simple to very complex, and are typically due early in the year. Many municipalities have implemented these reports to comply with state requirements such as Pennsylvania’s Municipal Waste Planning, Recycling and Waste Reductions Act (Act 101). Please contact Edge if you need any assistance.

At Edge, we constantly monitor the market for ways to help our customers improve their sustainability efforts and reduce costs. Please feel free to reach out to our experts should you have any questions related to the above articles or the environmental services industry.

September 2018

China Announces 25% Tariff on Imported Recycling

Starting August 23, 2018, China started imposing a 25% tariff on $16 billion of certain U.S. goods, including scrap. The tariff is in response to the U.S. enacting a 25% tariff on $16 billion of Chinese goods effective on the same date. China’s new tariff covers multiple recycling items including cardboard, paper, plastics and a number of scrap metals. The implementation of the tariff will undoubtedly add to the current turmoil in the U.S. recycling markets caused by the previously enacted product bans, tightened inspections and stricter contamination rate implemented by China’s National Sword policy.

Below is a summary of China’s National Sword policy to date.

- In July 2017, China announced its plan to ban 24 types of solid waste and recyclables and that it would impose a nearly impossible to meet .3% contamination rate. The announcement was greeted with some skepticism since China had a heavy dependence on the imported recyclables.

- However, on January 1, 2018, China placed a ban on 24 select categories of scrap as part of a promise to move away from all scrap imports by 2020.China Tariff

On March 1, 2018, China banned additional items and enacted a .5% contamination rate on the recyclable items that it continues to accept. China also enacted Blue Sky 2018 as a 10-month long period of ‘special actions’ against foreign garbage smuggling as the latest evidence that they are serious about keeping foreign garbage out of the country.

On March 1, 2018, China banned additional items and enacted a .5% contamination rate on the recyclable items that it continues to accept. China also enacted Blue Sky 2018 as a 10-month long period of ‘special actions’ against foreign garbage smuggling as the latest evidence that they are serious about keeping foreign garbage out of the country.- On May 4, 2018, China announced that is has halted all US scrap imports for one month in a surprise move.

In case you did not see it, Edge’s May 2018 Environmental Services Update covered the effects of National Sword in detail. Click here.

China’s new tariff adds yet another cost to an already struggling US recycling industry which will undoubtedly impair the already reduced scrap exports to China. Reducing the exports will have ripple effects of more stockpiling of material and probable reduced rebates.

Watch for future quarterly updates for a report on the added effects of the new tariff.

Driver Shortage continues to be a Top Issue for Waste Haulers and Recyclers

Over the past few years, waste haulers and recyclers have been finding it more difficult to find CDL applicants that want to work in the waste industry. During a recent Professional Recyclers of Pennsylvania (PROP) meeting, haulers and recyclers discussed the shortage and how the electronic logging device (ELD) mandate that took effect late last year added to the problem.

In December 18, 2017, the Federal Motor Carrier Safety Administration (FMCSA) implemented a new electronic logging device (ELD) mandate. One of the main purposes of using an ELD is to automatically record a driver’s driving time and other hours of service data. Where a manual logging system leaves some room for tweaking the numbers in order to run extra hours, the new devices are forcing companies and drivers to strictly adhere to daily hour limits that in affect have a negative impact on some driver’s pay. Unfortunately, the side effect is an added deterrent for some current drivers or future candidates.

With unemployment at historic lows, employers are dealing with stiff competition for workers in general. Mechanics, dispatchers and welders are also in high demand. As a result, companies are developing retention programs to retain their highly valued employees.

In a May 28, 2018 article in The Washington Post, the American Trucking Association estimates that about 51,000 more drivers are needed to meet the demand of companies like Amazon and Walmart.

The signs of the driver shortage are everywhere:Billboards show immediate openings for drivers.

- The first banner ad on Advanced Disposal’s home page reads “DRIVERS WANTED…Apply Today!”

- A quick look at the job postings on a few of the major haulers websites showed each advertising for hundreds of driver job openings. Many openings advertise signing bonuses of up to $5,000.

- Audubon, PA based waste hauler J.P. Mascaro recently asked a township to allow longer operating hours for its landfill so that drivers are not using their allotted daily time sitting and waiting for the landfill to open.

- J.P. Mascaro also recently opened a recruitment and training center in Pottstown, PA to act as a hub to hire and educate career seekers.

Autonomous vehicles may help with the driver shortage at some point in the distant future but the National Waste & Recycling Association (NWRA) expects the situation to get worse before it gets better.

Autonomous vehicles may help with the driver shortage at some point in the distant future but the National Waste & Recycling Association (NWRA) expects the situation to get worse before it gets better.

Because of the driver shortage, haulers in certain areas of the country have had to adjust their operations, postpone certain collections, and in some cases even turn away customers.

Action News Jax recently reported on August 10 that Jacksonville, FL issued fines to its three service providers after ongoing complaints of missed collections (over 42,000 so far in 2018 compared to 46,500 for all of 2017). According to Waste Dive, when contacted by Action News Jax for the article, Republic Services cited higher than expected collection volumes and an ongoing labor shortage.

Edge is monitoring this situation and continues to help customers with any service issues, some of which are possibly related to the driver shortage.

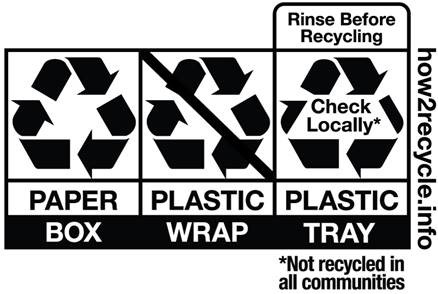

Many major retailers are switching to the more descriptive How2Recycle labels on their products.

The How2Recycle website states that its mission is to get more materials in the recycling bin by taking the guesswork out of recycling. The labels they introduced identify what parts of the packaging can be recycled and how each part should be prepared for recycling. Many major retailers like Aldi, Wegmans, Kellogg, and McDonald’s announced that they are switching to more descriptive recycling labels or have already switched.

How2Recycle began in 2008 as a project of the Sustainable Packaging Coalition. Although the How2Recycle label completed a soft launch in 2012, only a dozen or so major companies started to use the labels and only on select products. As of December 2017, the program consists of over 65 member companies that place the How2Recycle label on packaging.

Many major retailers like Aldi, Wegmans, Kellogg, and McDonald’s announced that they are switching to more descriptive recycling labels or have already switched.

The labels have four parts as indicated below (top to bottom):

- how to prepare each component for recycling

- icon showing typical recycling availability

- type of recyclable material

- recyclable parts of packaging

Below is a sample label for a multi-component container.

With all of the changes that are affecting the recycling industry, it is now more important than ever to watch what goes into recycling containers. Hopefully this change will help consumers and businesses to ‘Recycle Often, Recycle Right’.

For more information on recycling labels, visit:

https://www.wastedive.com/news/aldi-adopts-recycling-label-across-store-brands/527739/

May 2018

Edge Insights’ experts are constantly monitoring the Environmental Services industry in order to help ensure the best possible pricing and contract terms for our clients. The following report lists some of the recent news in the Environmental Services industry.

The following paragraphs describe how the recycling industry is being affected by contamination in all categories of recyclable scrap material.

China’s New Recycling Restrictions

Starting in July 2017, China placed a ban on 24 select categories of scrap. Early this year, China banned additional items and placed tough restrictions on the recyclable items that it continues to accept. On 5/4, China announced that is has halted all US scrap imports for one month in a surprise move.

These moves by China are causing havoc in the industry. Recyclers are scrambling to find other outlets for the material and are being forced to stockpile some materials. In addition, the rebates that are paid for the recyclables have plummeted.

Recovered paper prices are published monthly by Pulp & Paper Week for the different regions of the US. Here are a couple examples of how much recycling rebates have dropped from March of 2017 to May 2018 for the New York region (also reflective across the country).

Baled cardboard: $180 to $70 (referred to as OCC meaning old corrugated containers)

Mixed paper: $95 to $0 (newspaper, magazines, office paper, pamphlets, etc.)

* Rates shown are NY High prices per ton

Market analysts are predicting that recovered paper prices will continue to fall because of China temporarily halting all US shipments.

Market analysts are predicting that recovered paper prices will continue to fall because of China temporarily halting all US shipments.

China’s policy is called National Sword and it was put in place to limit the import of contaminated recyclable materials and to increase inspections of the material. According to the Huffington Post, China processed at least half of the world’s exports of waste plastic, paper and metals in 2016. But last year, China decided that it no longer wanted to be the world’s recycling bin primarily because of the amount of trash that was being included with the recycling.

Haulers and Recyclers are Feeling the Impact

A year ago, recyclers were making large profits by handling, sorting and selling recyclables. Some recyclable items were big winners, some small winners, and some break even. But overall, it was a good situation.

At the end of last year, recyclers were showing much smaller profits after China started to implement its restrictions and commodity rebates declined.

Now, recyclers are showing even smaller profits and some of the costs are being passed onto haulers.

Now, recyclers are showing even smaller profits and some of the costs are being passed onto haulers.

Export recyclers are really feeling the pain. What used to cost them $800 to ship material to China on a back haul is now costing upwards of $1,300 to ship to India or elsewhere.

Many recyclers will no longer take a chance to ship material to China even if they have improved their process in fear of rejection and having to pay possible fines and charges to return the material.

Recyclers are trying to clean up their act but it comes at a price. They are adding manpower and/or additional automatic sorting mechanisms to their sorting lines in order to reduce their contamination rate. These changes are good but long overdue. The industry was actually its worst enemy because it was seeking high profit margins on a poor product.

Recyclers are trying to clean up their act but it comes at a price. They are adding manpower and/or additional automatic sorting mechanisms to their sorting lines in order to reduce their contamination rate. These changes are good but long overdue. The industry was actually its worst enemy because it was seeking high profit margins on a poor product.

When haulers take single stream recyclable materials to a recycling center for processing, they pay a tipping fee. The tipping fee is a charge to dump the material at the recycling center. Because of the effects of China’s new restrictions and the associated extra processing costs, tipping fees are on the increase and haulers are more frequently charged additional charges for excessively contaminated loads.

Haulers Respond with New Fees and Rate Increases

In response primarily to the impact of China’s new restrictions, US haulers are coming up with creating ways to cover the increased costs related to recycling.

In late February 2018, Advanced Disposal started adding a new fee to their customer’s invoices called a Compliance & Business Impact Charge. Advanced’s website justifies the new fee by stating that their ‘operating locations have and will continue to incur rising business impacts’.

On May 1, 2018, Penn Waste notified Edge that is was going to be contacting all of their customers in reference to adding a 10% sustainability fee to all of their accounts effective June 1, 2018. The collapse of the recycling markets was stated as one of the reasons for the fee.

On May 8, 2018, Edge received notice that WM is going to be charging contamination charges based on the size of the container for excess contamination.

Edge has also seen other haulers arbitrarily increasing their rates and/or fees.

As always, Edge is working with the haulers to reverse these new fees and increases in order to minimize the impact of these changes on Edge customers.

As a result of these changes in the recycling marketplace, Edge anticipates even lower rebates on recyclable materials, higher costs for general recycling for businesses and homeowners, and possible changes to single stream recycling.

As stated in last quarter’s issue, the bottom line is to ‘Recycle Often, Recycle Right’ with ‘Quality over Quantity’.

At Edge, we constantly monitor the market for ways to help our customers improve their sustainability efforts and reduce costs.

Please feel free to reach out to our experts should you have any questions related to the above articles or the environmental services industry.